Trial by fire: How important is capital structure?

“Show me the incentive, and I’ll show you the outcome.” – Charlie Munger

On the eve of September 11th, 2025, members of Congress called the private equity fire truck roll-up REV Group to testify about their business and its impacts on fire safety in America. I encourage anyone interested to watch the full hearing on the Senate website: Sounding the Alarm: America’s Fire Apparatus Crisis.

The Wall Street Journal’s headline sums it up well:

Basel Musharbash, a lawyer who testified in front of Congress and wrote an article just following the fires titled: “Did a Private Equity Fire Truck Roll-Up Worsen the L.A. Fires?” outlined the problem in detail. “The cost of fire trucks has skyrocketed in recent years—going from around $300-500,000 for a pumper truck and $750-900,000 for a ladder truck in the mid-2010s, to around $1 million for a pumper truck and $2 million for a ladder truck in the last couple years.”

Private equity had consolidated the Fire Truck industry in America, and began increasing prices while simultaneously decreasing product quality—a typical PE formula—creating increased profits for REV Group’s private equity owners American Industrial Partners (AIP). Even worse than the cost, wait times for new trucks more than quadrupled from under a year to over four years—creating a large backlog that the AIP-installed CEO repeatedly bragged about as “financially attractive” for its positive impact on revenue visibility in K-1s and earnings calls. In 2024, REV Group’s fire truck division grew profits an exceptional 8.9 percent while AIP simultaneously “sold nearly all of its shares, but before doing so awarded a special dividend of $180 million of which nearly $80 million went to AIP.”

While REV Group has undoubtedly been a success for AIP and made its partners much wealthier (it made at least one AIP partner a billionaire), the company highlights the seriousness and potential pitfalls of the short-term profit-above-all-else ethos (feel free to use the corresponding euphemism “fiduciary duty” if that offends your sensibilities) that is the heart of the private equity industry. But, as Arkansas fire chief Gil Carpenter put it: “When is enough enough? And at what point are you going to sacrifice public safety for profits?”

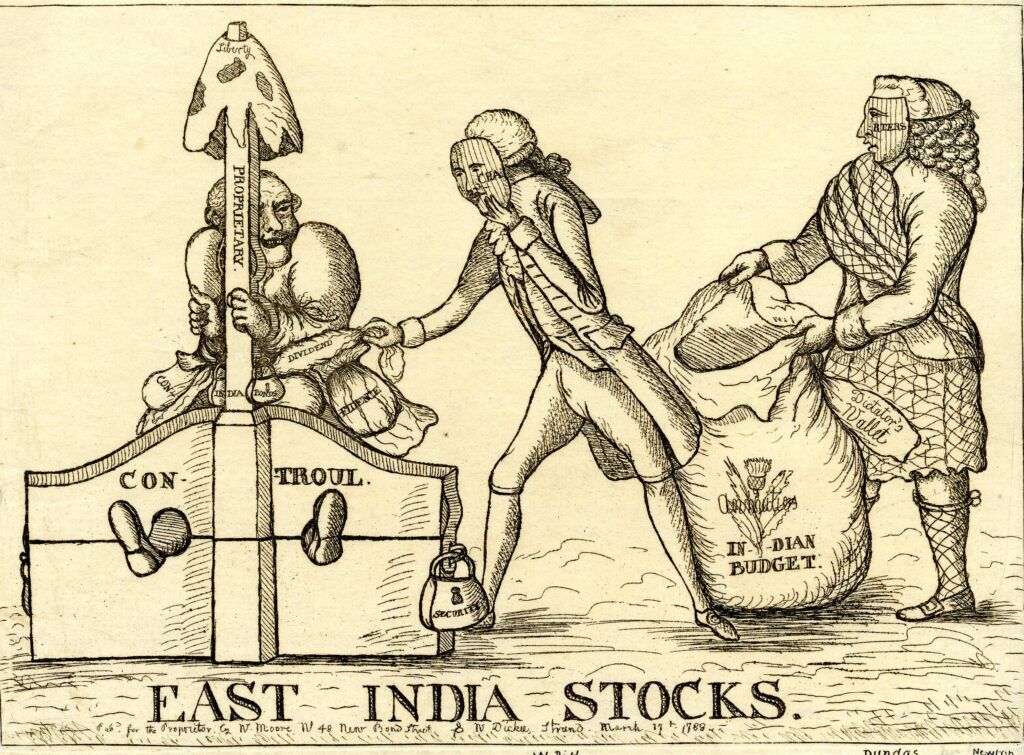

It would be a mistake to understand this as a case of capitalism gone wrong. Adam Smith, the father of modern capitalism, believed that complete separation of management and shareholders created a serious risk to society. He believed this so seriously that the final sentence of Book 1 ends with the warning that pure shareholders (à la modern private equity fund ‘investors’) are “an order of men, whose interest is never exactly the same with that of the public, who have generally an interest to deceive and even to oppress the public, and who accordingly have, upon many occasions, both deceived and oppressed it.”

In Book IV Chapter 7, Smith calls out the East India Company practice of destroying entire fields of harvestable crops to create scarcity for the sole reason “that extraordinary profit was likely to be made.” Is this any different from the REV Group’s practice of acquiring fire truck manufacturing facilities, only to close them shortly after acquisition resulting in longer repair and delivery wait times and an over-inflated order backlog, which the PE-installed CEO repeatedly referred to as financially attractive? If Adam Smith wouldn’t use the term Capitalist to describe either company’s leadership, what would he call them?

Decades ago, the fire truck industry looked very similar to the ERP industry, with many small, specialized companies manufacturing and repairing fire trucks for their local markets. Today, three companies—REV Group, Oshkosh (Pierce Manufacturing), and Rosenbauer—have nearly 80% market share. The short-term profit-maximizing incentives associated with private equity ownership creates bad behavior, which only gets worse as industries consolidate and concentrate.

At Mirador, we’re working against private equity consolidation of the ERP industry, because we’ve seen the perverse incentives and their damaging consequences. While they haven’t reached the severity of threatening human lives—it doesn’t make them any less palatable for the customers and employees who suffer as PE firms consolidate and subsequently weaken companies in the name of short-term profit.

In the words of the late Charlie Munger, “show me the incentive, and I’ll show you the outcome.”

Incentives are ultimately decided by ownership.

We are different because we believe in remaining independently-owned and owner-operated to retain our long-term focus and customer-centric strategy. We believe that you can’t know what’s best for a company if you don’t work in that company, and you can’t know what’s best for a customer or employee if all they are to you is a row on a spreadsheet.

What do you think about the impact PE consolidation is having on other markets? I’d love to discuss it, so reach out to me on LinkedIn or send us an email.